Celebrating Affinity’s first 100,000 customers in Ghana

The digital financial institution reached this milestone in less than a year after launch, driven by word of mouth and customer advocacy

Affinity Africa, Ghana’s leading digital banking platform, today announced it has surpassed 100,000 customers. This milestone reflects the rapid organic growth powered by word of mouth and customer advocacy, as more Ghanaians turn to Affinity for simple, affordable, and inclusive banking.

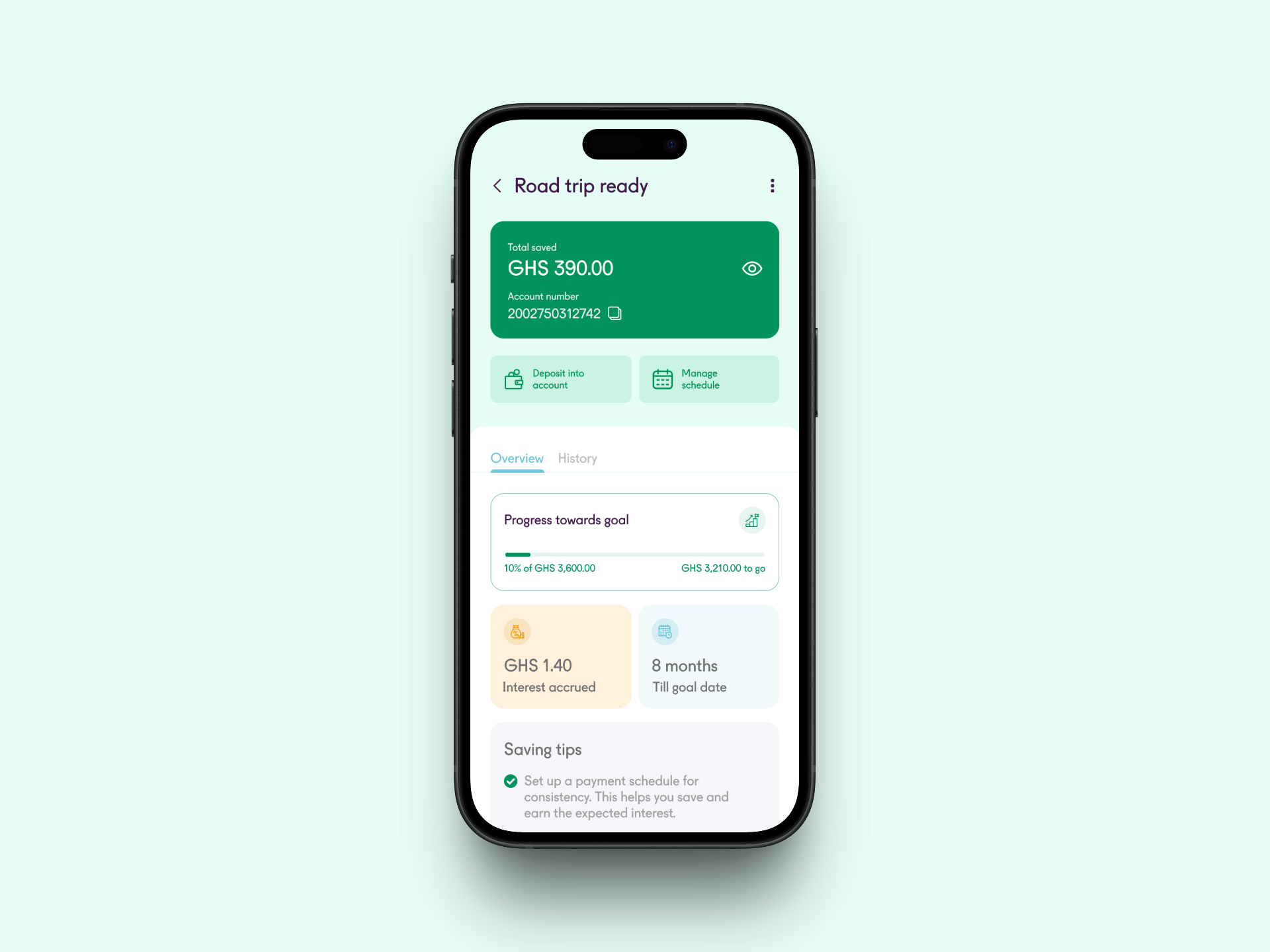

Founded to challenge the status quo in African banking, Affinity is redefining how financial services are delivered in Ghana. By offering free accounts, fair-interest savings, affordable loans, and seamless digital onboarding, the platform has quickly become the go-to banking partner for individuals and micro, small, and medium enterprises (MSMEs) nationwide.

“The idea that banking could be free, fair, and accessible was long dismissed as impossible in Ghana,” said Tarek Mouganie, Founder and Group CEO of Affinity Africa. “We have shown the opposite. Reaching 100,000 customers ahead of target, with little to no marketing spend, is proof that when you design the right product, customers themselves become your biggest advocates. Our growth has been driven by word of mouth, virality, and genuine customer love.”

Unlike many financial institutions that rely on heavy marketing to scale, Affinity’s growth has been almost entirely organic. Customers have become the platform’s strongest advocates, sharing their experiences with friends, family, and peers, and driving virality across social media. This word-of-mouth momentum reflects the strength of the product itself: simple, transparent, and designed around the real needs of Ghanaians.

“What’s attracting customers to Affinity is not campaigns or promotions, but the product itself,” said Abdul-Jaleel Hussein, CEO of Affinity Ghana. “From instant onboarding to transparent pricing and some of the most competitive interest rates in the country, Ghanaians are choosing Affinity because they finally see a financial institution built around their needs. And with our proprietary underwriting, many are accessing credit for the very first time, opening doors for households and businesses that were previously excluded.”

Since its public launch in October 2024, Affinity has rapidly scaled to become Ghana’s leading digital banking player. This journey began with the license grant in March 2022 (the first of its kind in 14 years) followed by the approval of its mobile app in December 2023. In less than a year, Affinity has built a complete banking portfolio that spans savings accounts, investments, instant loans, seamless transfers, full interoperability with mobile money, and more. By combining innovation with affordability, Affinity is delivering a banking platform that serves both the formal and informal economy, ensuring all Ghanaians access to the same full suite of financial services.