Affinity Africa Named to the 2025 CB Insights’ List of “The 100 Most Promising Fintech Startups”

The Ghanaian fintech was recognized as part of a new generation of companies building the future of financial services.

New York, October 23 2025. CB Insights named Affinity Africa to its eighth annual Fintech 100, showcasing the 100 most promising private fintech companies in the world.

“This year’s Fintech 100 showcases a new generation of companies turning AI, automation, and digital assets into the backbone of financial infrastructure,” said Laura Kennedy, Principal Analyst at CB Insights. “This year’s winners are building the infrastructure that will shape the future of financial services.”

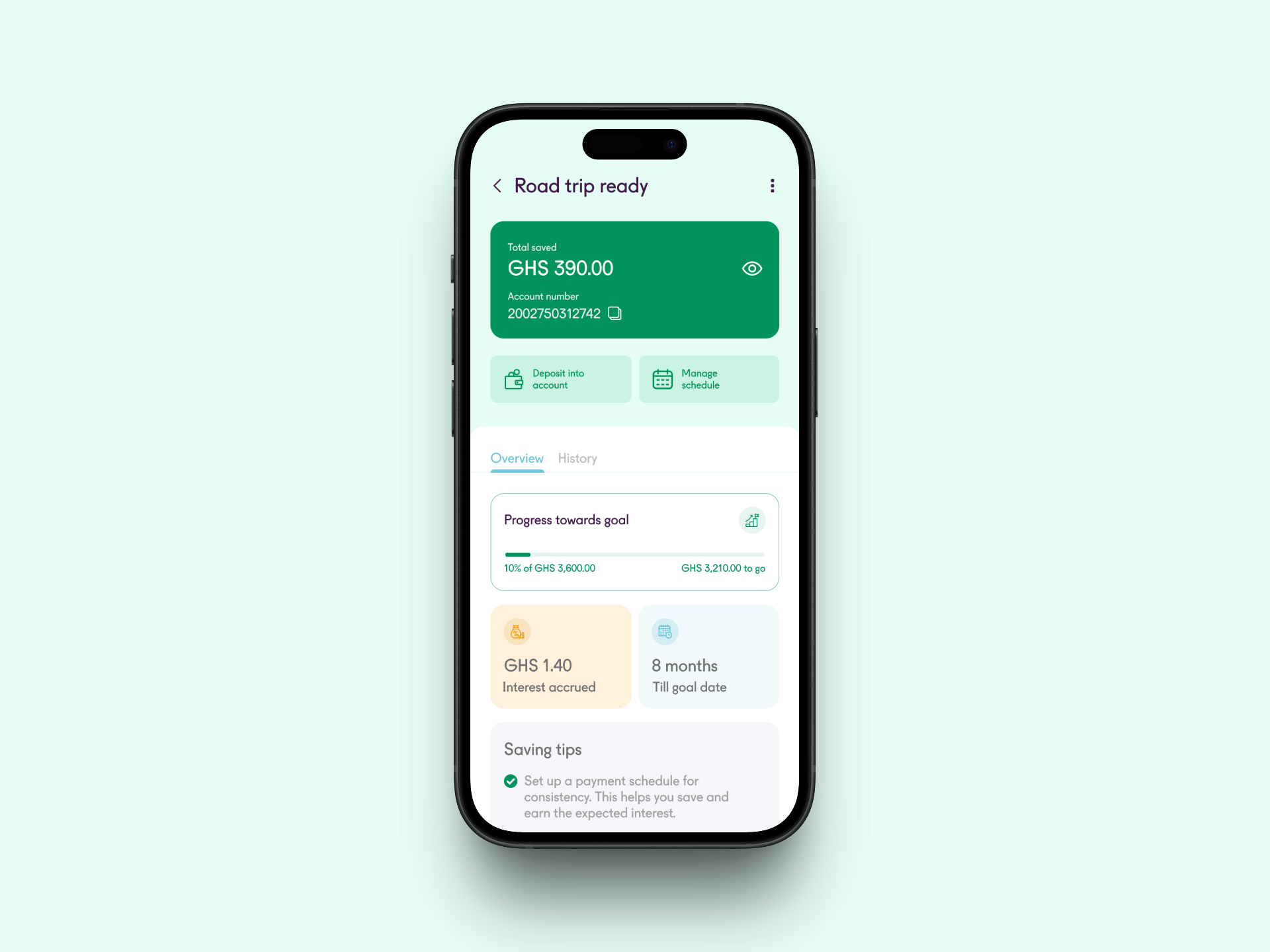

Having recently surpassed 100,000 customers, Affinity is redefining how financial services are delivered in Ghana. With free accounts, fair-interest savings, affordable loans, and seamless digital onboarding, the platform has quickly become the go-to banking partner for individuals and micro, small, and medium enterprises (MSMEs) across the country.

“This recognition is a testament to the work our team is doing to reimagine banking for the African majority. At Affinity, we believe financial services must be accessible, affordable, and grounded in the realities of everyday people and small businesses. By combining world-class technology with a hyper-local approach, we’re building a model that addresses deeply local challenges at scale. We’re proud to represent Ghana, and the continent, on this global list”, said Tarek Mouganie, Founder and Group CEO at Affinity Africa.

The list features early- and mid-stage startups driving the evolution of fintech. Utilizing the CB Insights Strategy Terminal, the 100 winners were selected based on several factors, including CB Insights datasets on deal activity, industry partnerships, investor strength, hiring momentum, and private company signals such as Commercial Maturity and Mosaic Scores. They also reviewed Analyst Briefings submitted directly by startups and leveraged Scouting Reports, powered by CB Insights’ Team of Agents.

Quick facts on the 2025 Fintech 100:

1. The 100 winners include 20 companies across digital assets solutions, 16 in financial operations and HR, 14 payments companies, and 13 in wealth management.

2. 60+ companies on the list deploy AI in their solutions, and AI agents in particular are moving from workflows to financial infrastructure.

3. $5.6B in equity funding raised over time, including more than $2B in 2025 so far (as of 10/22/2025).

4. 60 companies from outside the United States, across 26 countries on 6 continents.

5. 640+ business relationships since 2021, including with industry leaders like Mastercard, Visa, Worldpay, Coinbase, and Circle.

For more information, visit www.affinityafrica.com.

About Affinity Africa

Affinity Africa is a digital banking platform founded by Tarek Mouganie and headquartered in Ghana, dedicated to providing affordable and accessible financial services to underserved and unbanked individuals, and micro, small, and medium enterprises (MSMEs). Powered by a proprietary technology platform, a branchless business model, and robust credit underwriting capabilities, Affinity offers 24/7 banking services tailored to both digital natives and users with limited digital literacy, driving financial inclusion at a low cost. With no monthly fees or transaction charges, Affinity is among the most affordable and cost-effective players in the region.

The company was founded in 2022, when it received a Savings and Loans license from the Bank of Ghana, the first of its kind granted in over 10 years, and officially launched operations in October 2024, following the regulatory approval of its mobile app. Today, it offers a comprehensive suite of products, including personal and SME accounts, savings, payments, transfers to banks and mobile money wallets, investments, and loans.

Affinity has made a profound impact in the region. It has empowered a large underserved population with easy-to-use affordable banking services, and it has financially included thousands of Africans into the system, who had been previously neglected by traditional banks: 65% of Affinity’s customers never had access to formal banking products and 60% are women operating in the informal sector.

To date, Affinity has raised US$13 million in total funding, including an US$8 million Seed Round, to support its mission to bridge the financial services gap across Sub Saharan Africa.

About CB Insights

CB Insights is the leader in predictive intelligence on private companies. It delivers instant insights that help you source and analyze private companies, focus on the right markets, and stay ahead of competitors. Our AI agents are powerful because they translate signals into the exact outputs your teams need to move first — defensible, sourced, and board-ready. To learn more, please visit www.cbinsights.com.