Affinity Boost: a new way to earn interest while saving towards goals

A customer-inspired product that lets users set savings goals, choose flexible tenors, and top up funds to grow their money faster. Designed to make every Cedi count.

Accra, August 2025 – Affinity Africa, Ghana’s leading digital banking platform, announces the launch of Affinity Boost, a new goal-based savings account designed to help individuals and small business owners accelerate their financial goals by earning competitive returns. With this new product, Affinity continues to reimagine digital banking in Africa by offering inclusive, flexible, and high-yield financial products that put customers in control of their money.

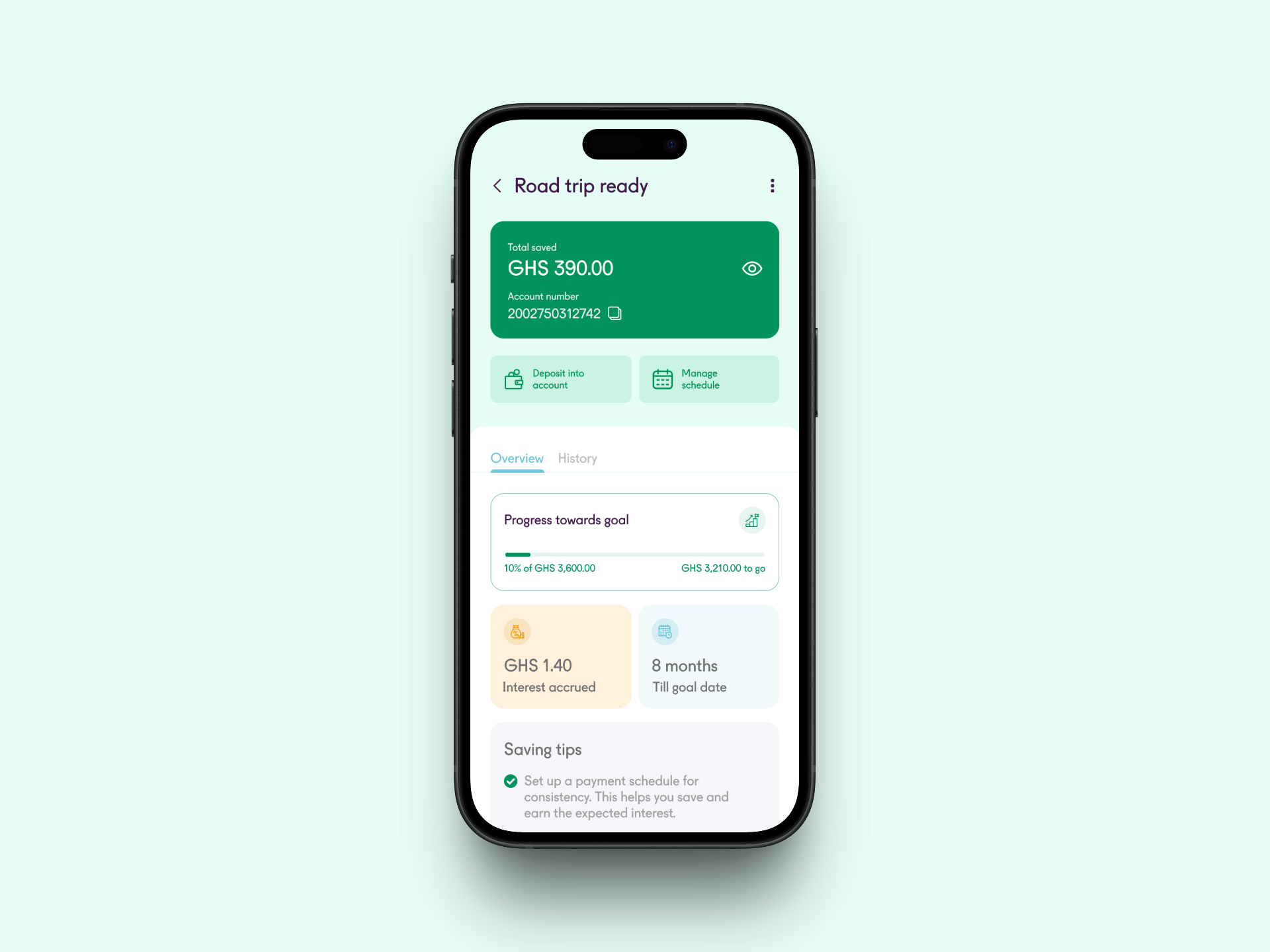

Affinity Boost enables customers to set specific savings goals—such as buying a motorcycle, starting a business, or booking a trip—and choose a fixed period of time (tenor) to grow their money, earning a competitive annual interest. What sets the product apart is that it also introduces a top-up functionality, allowing users to add extra funds at any time or set up automated daily/weekly/monthly scheduled transfers into the account to increase their returns and reach their goals faster.

“This product was built in response to real feedback from our customers, many of whom wanted the option to add more money into their yield-generating accounts when they had extra cash,” said Abdul-Jaleel Hussein, CEO of Affinity Ghana. “Affinity Boost is a direct result of listening to the voice of our customers and building for what matters most: helping them achieve their goals”.

The launch of Affinity Boost expands the company’s suite of transactional and high-yield savings accounts—Affinity Daily, Affinity Growth and Affinity Future— which offer a range of tenor and return combinations tailored to meet different financial needs and customer profiles. Whether customers prefer daily liquidity, shorter terms for quick wins or longer durations for higher returns, they will find the perfect option for them within Affinity’s flexible deposit products. Beyond savings, Affinity also provides a robust lending portfolio with some of the best rates in the market—including Instant Loans, short-term Working Capital, and long-term Growth Capital—empowering individuals and MSMEs to access affordable credit on their own terms.

Along with Affinity Boost, the company is introducing a newly redesigned app and website. In the app, customers can have full visibility on their savings progress via an intuitive and transparent dashboard, as well as easy-to-use, simple interface to do daily tasks like payments and deposits. In the website experience, users can access web-banking tools and even apply for an instant loan with a few clicks.

Affinity has seen rapid adoption of its digital banking services: with over 80,000 customers onboarded, roughly 80% are actively using mobile app. Notably, 55% of customers who started with Affinity’s agent network later transitioned to using the mobile app, underscoring the platform’s role in driving financial and digital literacy.

“As more Africans demand smarter tools to manage their finances, we remain committed to designing banking products that serve their needs,” added Tarek Mouganie, Founder and Group CEO of Affinity Africa.

For more information, visit www.affinityafrica.com.

About Affinity Africa

Affinity Africa is a digital banking platform founded by Tarek Mouganie and headquartered in Ghana, dedicated to providing affordable and accessible financial services to underserved and unbanked individuals, and micro, small, and medium enterprises (MSMEs).

Powered by a proprietary technology platform, a branchless business model, and robust credit underwriting capabilities, Affinity offers 24/7 banking services tailored to both digital natives and users with limited digital literacy, driving financial inclusion at a low cost. With no monthly fees or transaction charges, Affinity is among the most affordable and cost-effective players in the region.

The company was founded in 2022, when it received a Savings and Loans license from the Bank of Ghana, the first of its kind granted in over 10 years, and officially launched operations in October 2024, following the regulatory approval of its mobile app. Today, it offers a comprehensive suite of products, including personal and SME accounts, savings, payments, transfers to banks and mobile money wallets, investments, and loans.

Affinity has made a profound impact in the region. It has empowered a large underserved population with easy-to-use affordable banking services, and it has financially included thousands of Africans into the system, who had been previously neglected by traditional banks: 65% of Affinity’s customers never had access to formal banking products and 60% are women operating in the informal sector.

To date, Affinity has raised US$13 million in total funding, including an US$8 million Seed Round, to support its mission to bridge the financial services gap across Sub-Saharan Africa.

More information at: https://www.affinityafrica.com